Mindspeed Technologies Inc. is a Fabless Semiconductor Company

Mindspeed Technolgies is a fabless semiconductor company that is likely to be acquired in the near term at a substantial premium. The company has three product segments; communication convergence processors, high-performance analog, and wireless infrastructure.

On April 30th, Mindspeed Technologies announced that they had hired Morgan Stanley to evaluate strategic alternatives. Mindspeed Technologies is a leading global provider of network infrastructure semiconductor solutions. They could be very valuable to a big name player.

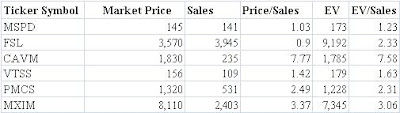

For acquisition purposes and considering this is in an industry with a high growth outlook, I looked at Mindspeed in comparison to its peers based on Price/Sales and EV/Sales (all numbers in millions).

Based on its peers the average Price/Sales Multiple is 3.19 and the average EV/Sales multiple is 3.38.

These multiples applied to MSPD would mean a Market Price of $450 million (north of $10/share) or an Enterprise Value of $477 million ( minus $74 million of debt plus $47 million of cash making equity again worth $450 million)

If Mindspeed was to be value based on a multiple of its gross profit, then you would get to a buy out value of $9.31/share (55.7% gross margin (2012A) * 141 million revenue = 78 million * a multiple of 5 = 393mm/42mm shares = $9.31) A lower work out value, yet still a huge premium to today's price.

Now, there are some comments on message boards doubting the idea that they will be acquired. Some have said that they hired Morgan Stanley so that they can dilute more shares. This seems unlikely however because in a recent investor presentation when asked if they would do such a thing CFO, Stephen Ananias said that they were very mindful of shareholder dilution.

I encourage everyone to listen to it here

Finally, the last suggestion I'll make is how to play this investment idea. You could simply go long the stock at $3.44. The other side is buying call options with a strike point of $2.50 with an expiration of December 21st for $1.35. Probably by then Morgan Stanley's work will be done.